Medtech Baxter International and funds managed by global investment firm Carlyle have signed a definitive agreement under which Carlyle is to acquire Baxter’s Kidney Care segment, to be named Vantive, for $3.8 billion.

Baxter announced its intention to create a standalone kidney care company in January 2023 as part of its broader strategic realignment designed to enhance future performance and create value for all stakeholders. In March 2024, Baxter announced that it was in discussions to explore a potential sale of the segment.

After reviewing the financial impact of the potential separation pathways, management and the Baxter Board determined that selling the business to Carlyle should maximize value for Baxter stockholders and best position Baxter and Vantive for long-term success, with enhanced flexibility to deploy capital toward opportunities that seek to accelerate each company’s respective growth objectives.

Carlyle has been a private equity investor in the medtech sector over the past decade, with investments in medical technology and diagnostic companies totaling over $40 billion in enterprise value. Moreover, Carlyle’s investment in Vantive is made in partnership with Atmas Health, a collaboration among three industry executives founded in September 2022 to focus on acquiring and building a market-leading healthcare business. The partnership, consisting of Kieran Gallahue, Jim Hinrichs, and Jim Prutow, brings a proven track record of creating value in the medical technology industry. Kieran Gallahue will serve as the Chairman of Vantive, working with CEO Chris Toth and the Vantive management team.

“Today’s announcement represents another critical step forward in the strategic transformation process we announced in early 2023. As a result of this proposed transaction, Baxter will emerge a more focused and more efficient company, better positioned to redefine healthcare delivery and advance innovation that benefits patients, customers and shareholders,” said José (Joe) E. Almeida, chair, president and chief executive officer at Baxter. “I am confident that, under Carlyle’s stewardship and Chris Toth’s leadership, the Vantive team will continue to build on the business’s 70-year legacy as a pioneer in kidney disease and vital organ therapies.”

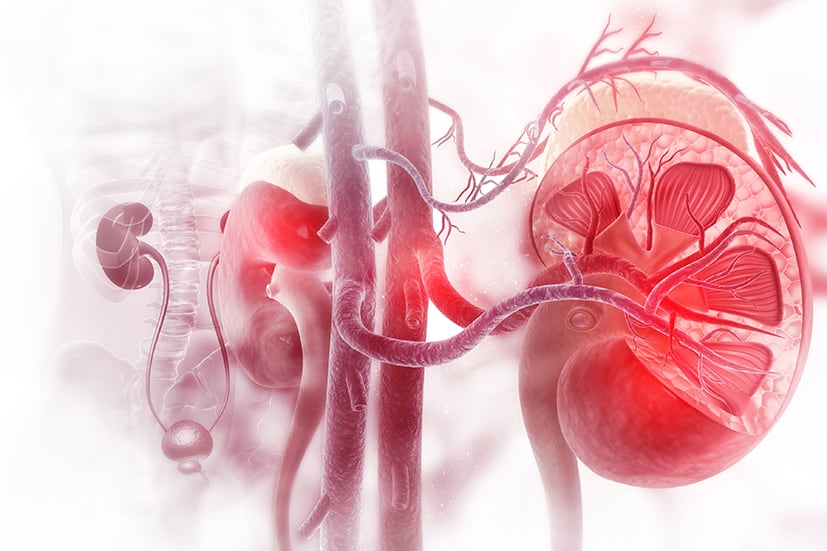

Vantive is a leader in global kidney care, offering products and services for peritoneal dialysis, hemodialysis and organ support therapies, including continuous renal replacement therapy (CRRT). The business has more than 23,000 employees globally and had 2023 revenues of $4.5 billion.

“I look forward to partnering with the combined Carlyle and Atmas team and working with my colleagues to advance Vantive’s mission of extending lives and expanding possibilities,” said Chris Toth, executive vice president and group president, Kidney Care at Baxter, who will serve as Vantive’s CEO. “Today’s announcement signals a new chapter in innovation on behalf of the patients and care teams around the world who rely on our solutions. Through this transaction, Vantive will be well-positioned to deepen our commitment to elevating dialysis through digital solutions and advanced services, while looking beyond kidney care to invest in transforming vital organ therapies.”

“The Atmas team is excited to support the growth of the Vantive business under the leadership of Chris Toth. We look forward to working together to build upon Vantive’s track record of patient-focused innovation and create long-term value in this next phase of the company’s development,” said Kieran Gallahue, co-founder of Atmas and chairman of Vantive upon closing of the transaction.

“Vantive is a strong, growing business with market-leading franchises, and we are delighted to partner with the Vantive team to pursue their strategic vision through the separation from Baxter and transformation into a standalone global business,” said Robert Schmidt, Carlyle’s Global Co-Head of Healthcare. “Carlyle is uniquely positioned to support management in that pursuit with our global investing platform across the Americas, EMEA and Asia, where each of our regional teams will partner with Vantive to seek to ensure the success of the business, its employees, as well as its customers and their ultimate patients worldwide.”